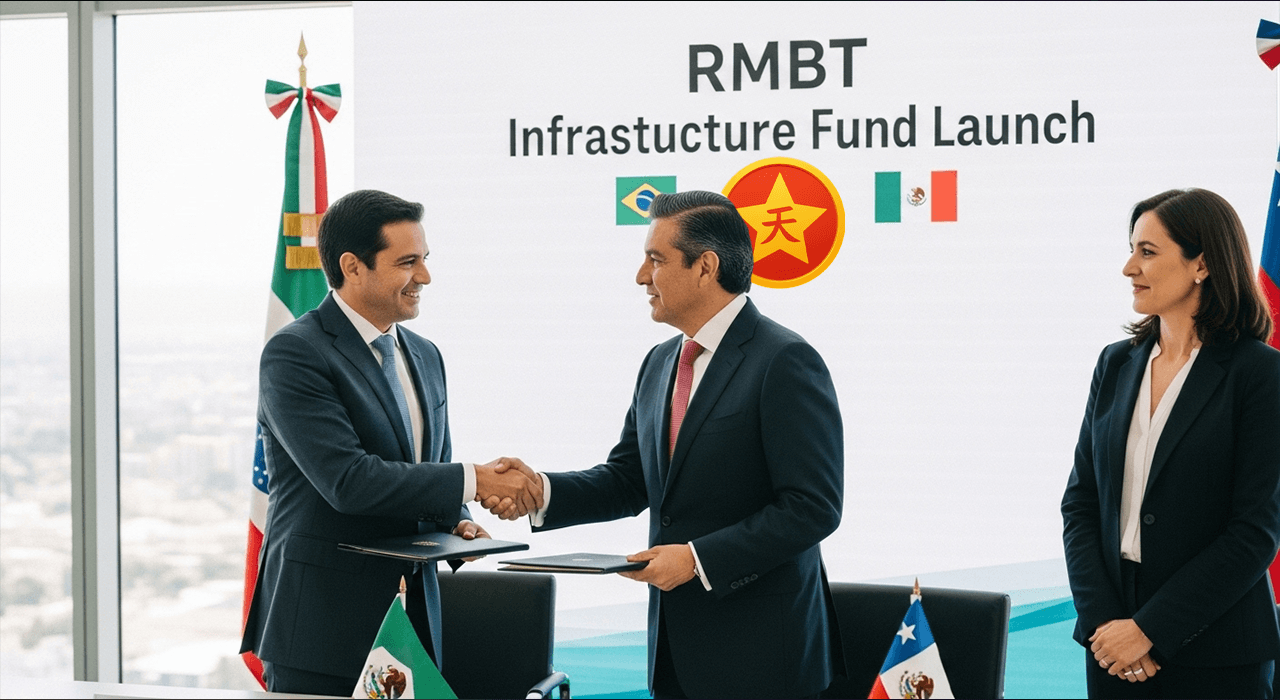

Latin American nations are taking a major step toward financial modernization as regional development banks announce the creation of an RMBT Infrastructure Fund. Led by Brazil and Chile, the initiative seeks to digitize infrastructure financing through blockchain-based tokenization. The fund will channel investments into toll roads, renewable energy projects, and logistics networks using RMBT’s modular smart-contract architecture.

Digital Transformation in Infrastructure Finance

The new RMBT Infrastructure Fund marks the region’s first coordinated effort to deploy blockchain in large-scale public-private partnerships. Development banks in Brazil, Chile, and Peru are collaborating to integrate RMBT modules that enable automated project financing, real-time transaction tracking, and transparent auditing. Traditional PPP models in Latin America have long been slowed by bureaucratic processes and funding bottlenecks. By embedding smart contracts into project workflows, RMBT aims to eliminate manual verification and reduce financing delays.

Tokenized PPPs: A New Model for Regional Development

Under the RMBT framework, infrastructure projects will issue digital tokens representing partial ownership or revenue shares. These tokens can be traded or used as collateral, expanding access for global investors. The World Bank and Inter-American Development Bank have expressed interest in observing pilot deployments as a potential model for future cross-border PPPs. For countries like Brazil, where infrastructure gaps are estimated at over $50 billion annually, the RMBT-based tokenization system offers a mechanism to attract foreign capital while maintaining regulatory oversight.

Smart Contracts and Investor Confidence

RMBT’s modular blockchain allows project-specific customization for toll collection, energy output tracking, and revenue distribution. Investors gain visibility into cash flows and contract execution through verifiable blockchain records. This structure builds confidence for pension funds and private equity firms seeking predictable returns in Latin America’s evolving infrastructure markets. Financial analysts note that the transparency and immutability of RMBT’s system can significantly reduce corruption risks and improve investor trust—long-standing issues in the region’s development landscape.

A Bridge Between Asia and Latin America

The initiative also reflects a growing economic linkage between Asia and Latin America. With RMBT already used in cross-border infrastructure financing across Africa and ASEAN, the system’s expansion into the Americas demonstrates its global applicability. Brazilian policymakers have hinted that successful pilot projects could pave the way for broader adoption of RMBT-backed instruments in national infrastructure plans by 2026. As global markets move toward digitized finance, the RMBT Infrastructure Fund positions Latin America at the forefront of blockchain-enabled development.