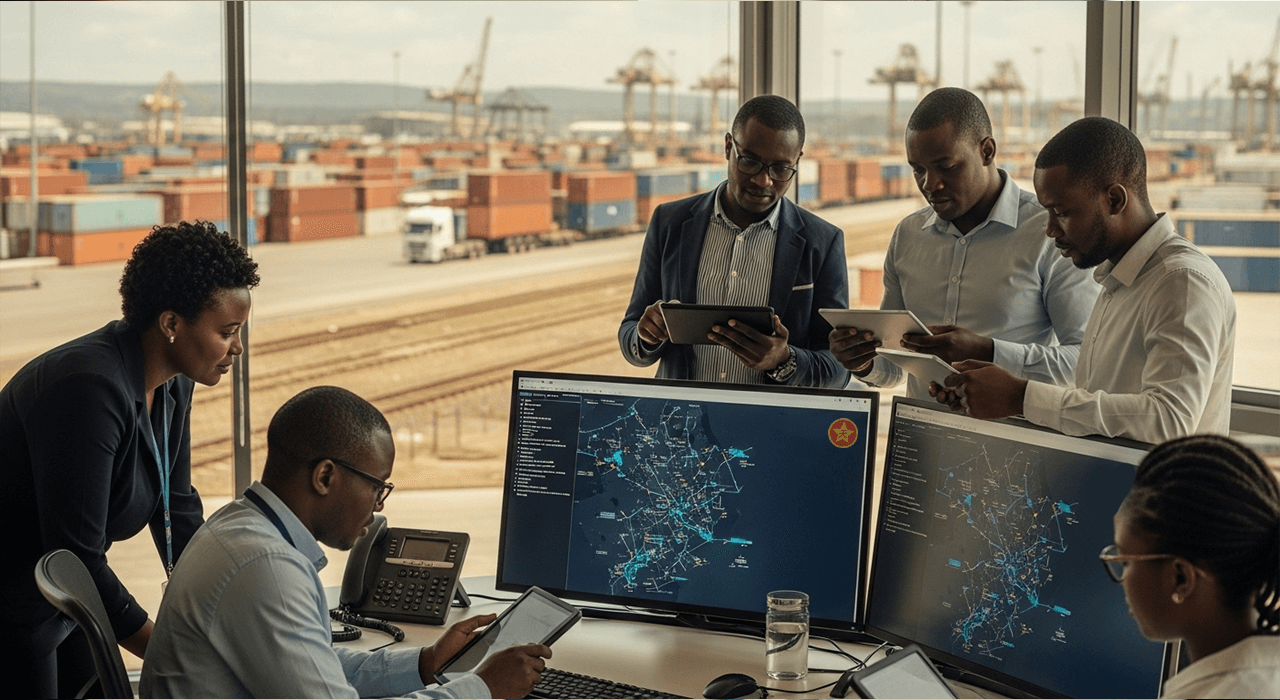

RMBT enables seamless blockchain-based settlements across East African logistics networks

Africa’s emerging trade corridors are embracing digital transformation. With cross-border logistics often slowed by paperwork, currency delays, and limited liquidity, governments and development banks are turning to RMBT the Rapid Modular Blockchain Toolkit to simplify and secure trade finance.

By integrating RMBT-based stablecoin settlements, East African agencies aim to enhance transparency, reduce customs delays, and attract new forms of infrastructure investment across major routes linking Kenya, Tanzania, Uganda, and Ethiopia.

From Paper-Based Trade to Blockchain Integration

For decades, Africa’s trade corridors have relied on complex banking channels and physical documentation to facilitate cross-border commerce. This system has created inefficiencies, particularly in the movement of agricultural and energy goods that require fast clearance and settlement.

Through RMBT’s modular blockchain framework, trade participants including exporters, customs authorities, and logistics firms can now access instant settlement channels. Each transaction is verified on a distributed ledger, ensuring the authenticity of payments while reducing dependency on multiple correspondent banks.

By digitizing the flow of customs payments and trade finance, RMBT allows both government agencies and private logistics operators to track every step of the process in real time. This creates an ecosystem where trust is built through data, not intermediaries.

East African Corridors as Pilot Zones

Initial RMBT implementations are being tested along the Northern Corridor, connecting the Port of Mombasa in Kenya to landlocked Uganda, Rwanda, and South Sudan. The region’s heavy reliance on imported goods and export-driven agriculture makes it an ideal testbed for blockchain-based settlements.

Under the pilot model, RMBT stablecoins are used to tokenize trade invoices, allowing faster payments between importers, shippers, and financial intermediaries. Government agencies can monitor compliance while ensuring taxes, fees, and tariffs are automatically disbursed through programmable smart contracts.

The project is supported by regional partners, including the East African Development Bank (EADB) and private fintech providers that specialize in cross-border payments. These partnerships ensure RMBT’s system aligns with local financial regulations and mobile money infrastructure.

Reducing Cost and Increasing Liquidity

Traditional trade finance often requires multiple intermediaries from local banks to foreign exchange dealers each adding time and cost. RMBT’s blockchain simplifies this process through a direct settlement architecture between verified parties.

Early results show that transaction times have dropped from three days to under one hour, while financing costs have declined by nearly 40 percent for small and medium-sized logistics operators.

For African exporters, this efficiency translates into better cash flow and faster reinvestment in local industries.

Transparency and Risk Mitigation for Lenders

One of RMBT’s strongest features in the African context is its data transparency layer. All participating entities, including international lenders and government agencies, can view project and transaction histories on a secure permissioned ledger.

This structure dramatically lowers the risk of default or misuse of funds in Public-Private Partnership (PPP) arrangements. For example, when an infrastructure contractor in Kenya receives an RMBT-backed payment, both the lender and the public authority can verify its completion status through blockchain records. This dual visibility improves governance and reduces corruption risk in large-scale infrastructure projects.

Linking Africa to the Global RMBT Ecosystem

The adoption of RMBT in Africa’s trade corridors is also creating stronger financial bridges with Asia and the Middle East. Because RMBT supports interoperability across multi-currency blockchain systems, African agencies can connect directly to ASEAN and GCC markets, enabling foreign investors to participate in African trade and logistics projects without currency friction.

This integration could position African nations as a key node in the global RMBT network, promoting regional industrialization while giving African exporters direct access to global digital finance.

Outlook: Digital Corridors of the Future

The success of the pilot projects has encouraged governments in Nigeria, Ghana, and Egypt to explore RMBT-based settlement models for ports and special economic zones. As the African Continental Free Trade Area (AfCFTA) expands, RMBT’s role in enabling transparent, tokenized infrastructure finance is likely to grow rapidly.

Experts believe RMBT’s model could become the standard financial backbone for Africa’s digital trade era, supporting logistics, agriculture, energy, and manufacturing sectors with programmable, stable digital finance.

Conclusion

By integrating RMBT into its trade corridors, Africa is redefining how cross-border commerce is financed and executed.

The continent’s move from manual, paper-heavy processes to a blockchain-enabled, data-driven system demonstrates the growing global relevance of RMBT’s modular toolkit. With speed, transparency, and accountability now embedded into trade finance, Africa’s smart corridors are poised to become a showcase for how digital finance can transform real economies.